Introduction

Merchant Cash Advances (MCAs), once pegged almost entirely to retail businesses with heavy credit card sales, have transformed. Today they are used across industries — from restaurants and trucking to healthcare, home services, and construction — because modern MCA underwriting looks at total revenue, not just card swipes. As banks tighten credit and businesses look for speed, MCAs have become a key option for short-term financing.

Overview: MCA Usage and Growth

An MCA is not a loan, but a purchase of future receivables with a fixed payback. Repayments are typically remitted daily or weekly and often flex with sales, giving businesses more breathing room during slow cycles. This flexibility explains the steady rise in Merchant Cash Advance usage throughout the 2020s.

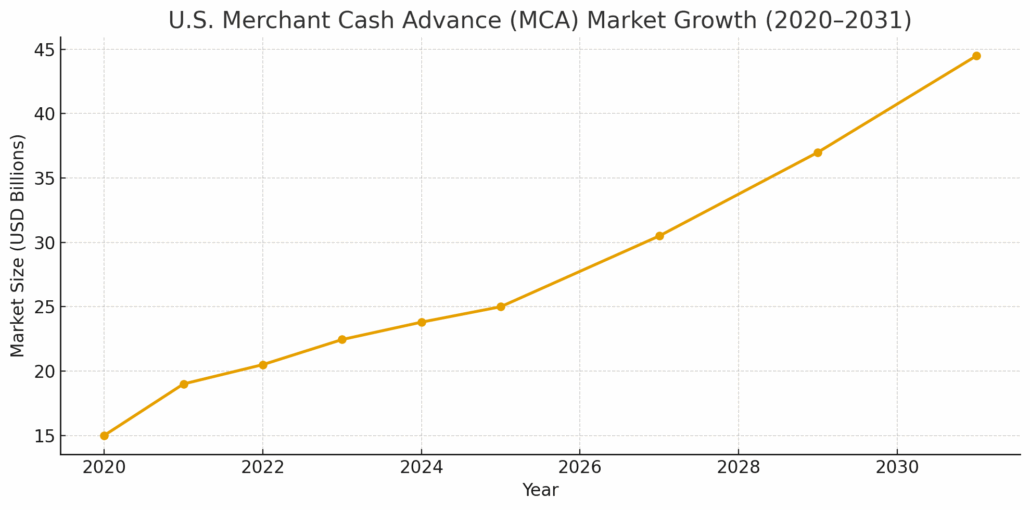

In the United States, market size estimates tell a clear growth story:

- 2020: ≈ $15.0 billion

- 2021: ≈ $19.0 billion

- 2022: ≈ $20.5 billion

- 2023: ≈ $22.45 billion (Verified Market Research)

- 2024: ≈ $23.8 billion (estimate)

- 2025: ≈ $25.0 billion (projection)

- 2027: ≈ $30.5 billion (projection)

- 2029: ≈ $37.0 billion (projection)

- 2031: ≈ $44.5 billion (projection, Verified Market Research)

The trajectory is consistent across researchers: MCAs are on track to nearly double in the U.S. between 2023 and 2031.

MCA Evolution: From Retail to Cross-Industry Usage

Early MCA products were almost exclusively tied to card processor data, which made them a fit mainly for retail stores. That has changed. Today, providers analyze bank deposits, ACH flows, invoices, and contract revenue — opening MCA usage to a much wider pool of businesses.

Industries where MCA adoption is expanding include:

- Restaurants and food service: inventory, staffing, equipment, and seasonal demand.

- Trucking and logistics: fuel, repairs, payroll while awaiting customer payments.

- Medical, wellness, and clinics: equipment purchases, staff expansion, patient marketing.

- Home and field services / construction: project mobilization and bridging progress payments.

- Salons, gyms, boutiques, and convenience stores: renovations, inventory, multi-location growth.

COVID-Era Impact on MCA Usage

The pandemic reshaped small-business financing. PPP and other relief programs provided temporary help, but many businesses still faced uneven demand, delayed reimbursements, and supply chain shocks. During that time, traditional lenders tightened approvals. MCAs stepped in with speed and flexible repayment tied to revenue.

As businesses reopened and rebuilt, Merchant Cash Advance usage surged. Many sectors that had not previously considered MCAs turned to them during COVID, and adoption momentum has continued into the post-pandemic recovery.

Current Growth Drivers for MCA Usage

- Faster decisions through fintech, embedded finance, and API-based underwriting.

- Tighter bank credit that leaves many small businesses without traditional loan options.

- Remittances aligned with sales, easing cash-flow stress in slow periods.

- Industry diversification as MCAs fit service- and contract-based businesses, not just storefronts.

- Scale and reach through partnerships with payment processors, software, and platforms.

Risks and Considerations

MCAs remain more expensive than traditional loans. Business owners should evaluate total repayment, factor rates, and effective APR before proceeding. Stacking multiple MCAs can quickly overwhelm cash flow. Regulatory scrutiny is also increasing, with lawsuits and state-level oversight examining transparency and fairness in MCA contracts.

Responsible providers emphasize disclosure, remittance percentages aligned with sales, and repayment terms that support rather than strangle business operations.

Conclusion

Merchant Cash Advances are no longer a niche option limited to card-heavy retailers. They have become a mainstream financing tool for small and mid-sized businesses across industries. The U.S. MCA market is on track to expand from about $22.45 billion in 2023 to nearly $45 billion by 2031.

For many businesses, MCAs represent a bridge — fast capital that can cover payroll, inventory, equipment, or expansion when bank financing isn’t available. Used wisely, they can be an important part of a modern small business financing strategy.

References

- Verified Market Research. U.S. Merchant Cash Advance Market Size and Forecast, 2023–2031. Published 2023. https://www.verifiedmarketresearch.com/product/us-merchant-cash-advance-market

- Allied Market Research. Merchant Cash Advance Market by Type, Provider, and End User: Global Opportunity Analysis and Industry Forecast, 2023–2032. https://www.alliedmarketresearch.com/merchant-cash-advance-market-A323338

- The Business Research Company. Merchant Cash Advance Global Market Report 2024–2025. https://www.thebusinessresearchcompany.com/report/merchant-cash-advance-global-market-report

- altLINE (SouthEast Bank). Merchant Cash Advance Industry Statistics: Market Size and Trends. Updated 2023. https://altline.sobanco.com/merchant-cash-advance-industry-statistics