Construction business financing are flexible enough to meet many different requirements. These are some of the most common uses for construction business funding:

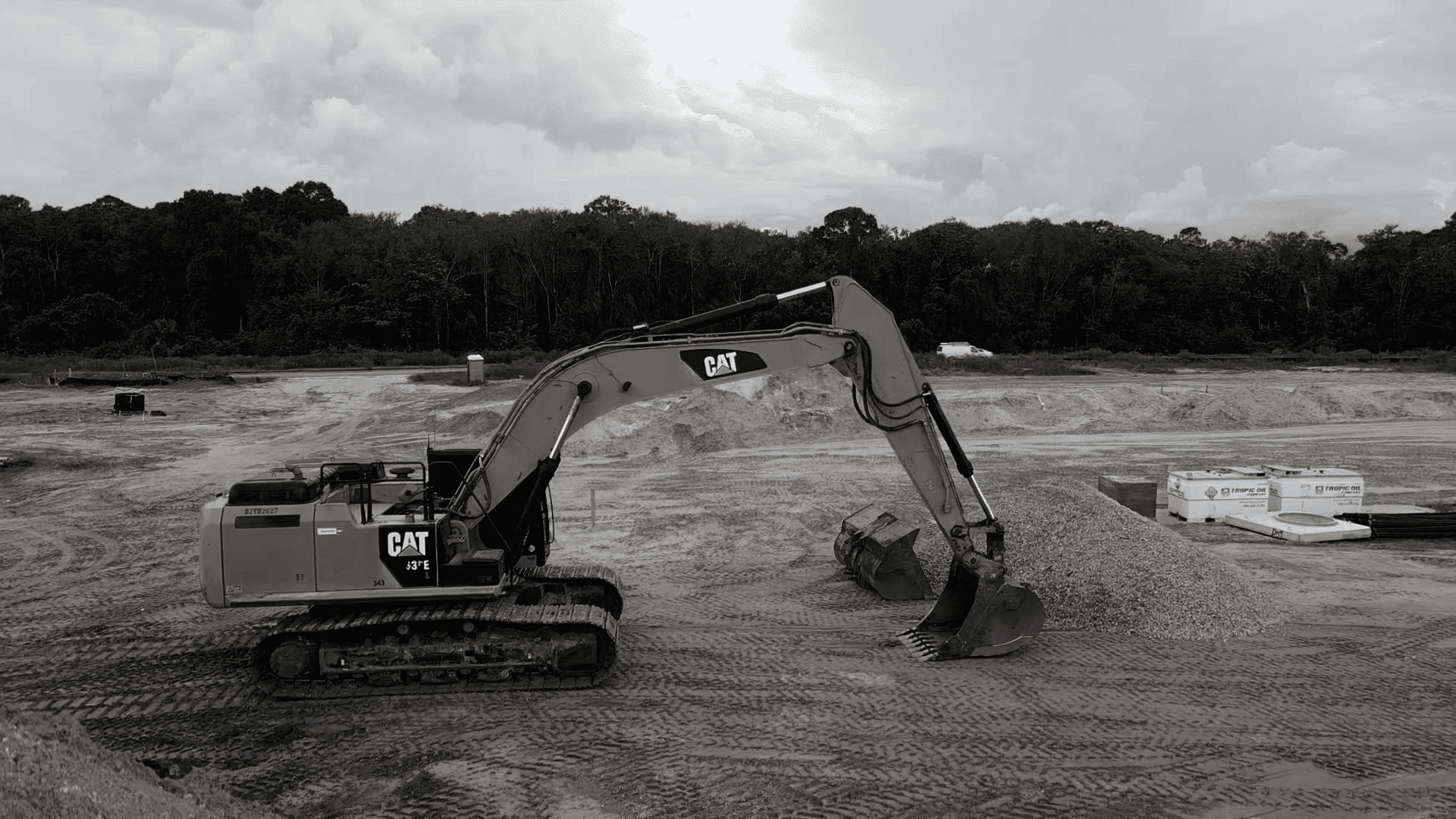

Leasing or purchasing new equipment

A construction loan can help you acquire heavy machinery, tools, and equipment you’ll need to run your business. For example, you might need to purchase a new backhoe or dump truck midway through a project. You may need fast construction business funding if you do not have the cash flow.

Building a construction project requires the hiring of workers

Taking on a construction project, no matter how big or small, is challenging when you don’t have a crew. Taking out a small construction loan could allow you to hire and train the workers you need for your next project.

Maintaining payroll or covering other operational expenses on a day-to-day basis

One of the most tedious aspects of operating a construction business is managing costs on a daily basis. Construction funding can provide your business with the cash it needs to cover payroll, taxes, insurance premiums, and other operating expenses.